Herman Simon, founding father of pricing science, said: "Price is what you pay. Value is what you get". With this in mind, we could pretty much end this blogpost. Try ensuring that your pricing reflects the value you provide as a SaaS tool. But that sounds easier than it is, right?

SaaS Pricing Fundamentals

To truly understand software-as-a-service pricing monetization strategies, we need to go back to the very basics and Marc Benioff's legacy from Salesforce. Value creation changed dramatically, so the pricing models had to follow. Cloud revolution reshaped the entire cost structure of software products: no distribution or shipping, limited hardware needed, different types of companies. If you add subscription models to the mix, you pretty much land in a totally new place where the traditional approach doesn't make sense. Interestingly enough, though, many companies still fall for it.

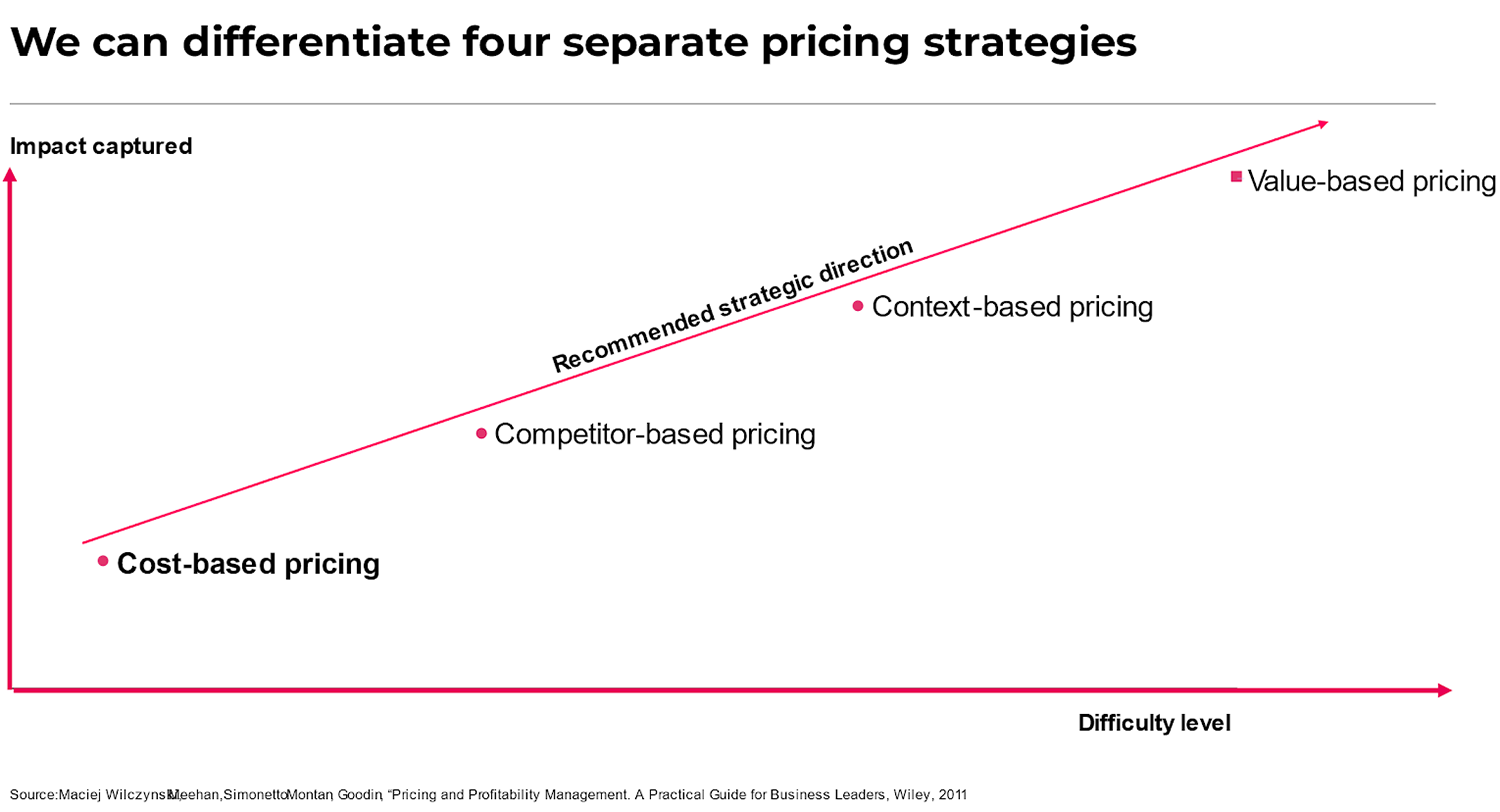

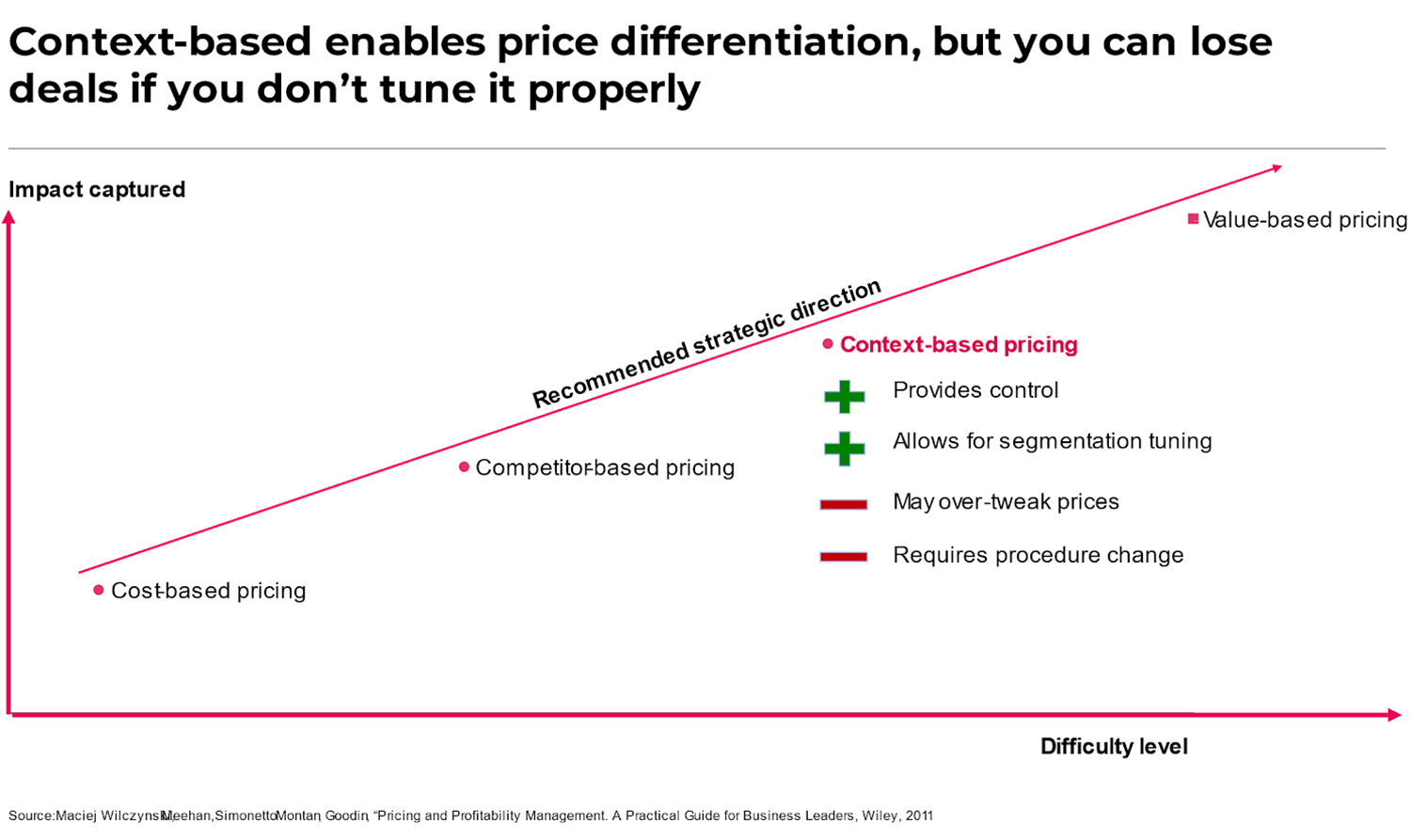

If you want to separate the pricing strategies, there are four of them. They differ in two dimensions: ease of application and impact (a.k.a. value) captured.

1) Cost-based pricing

2) Competitor-based pricing

3) Context/segment-based pricing

4) Value-based pricing

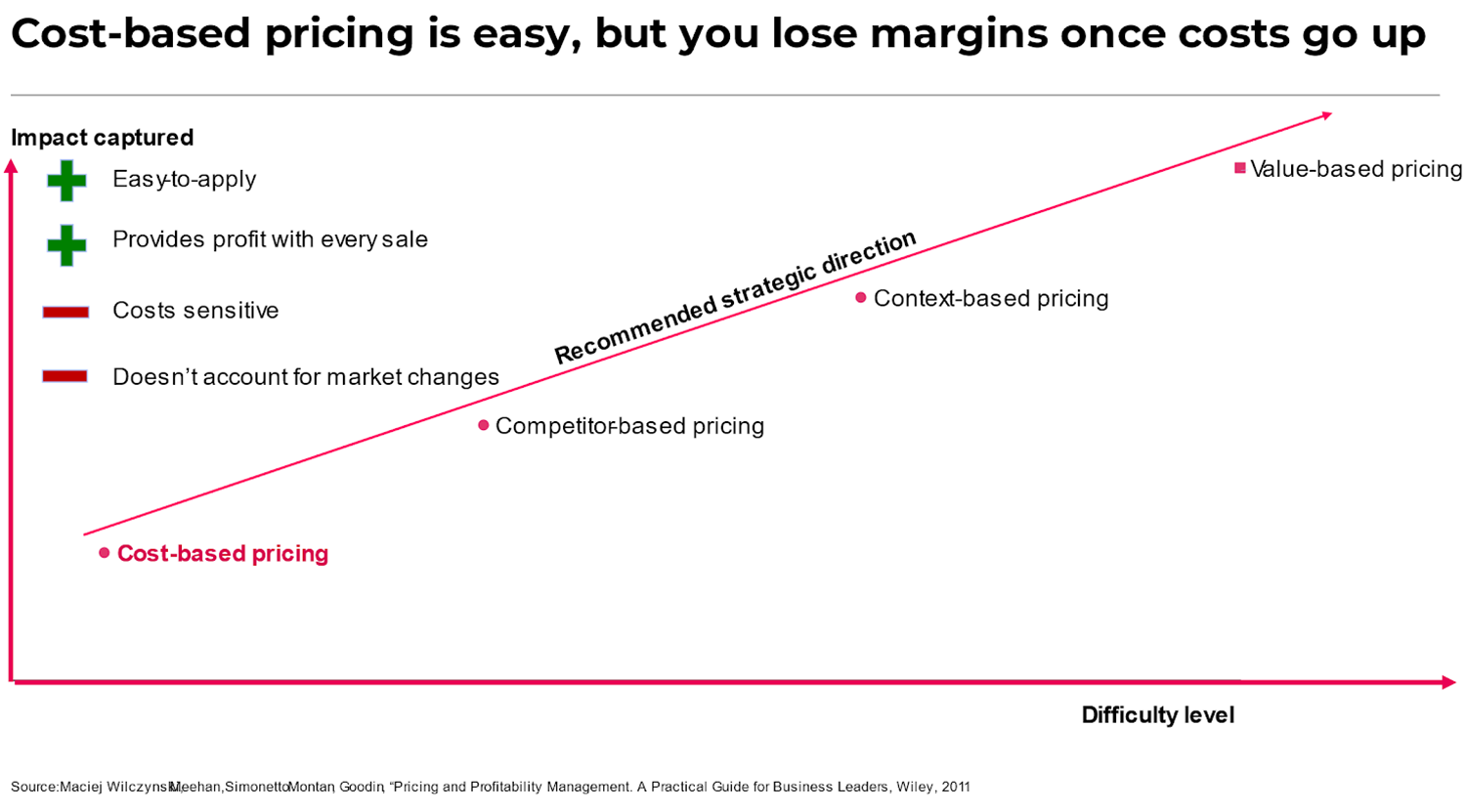

Cost-based pricing and why it won't fly

Cost-based pricing is what you would do if you ran a mom-and-pop shop. You buy (or in this case, develop) products at a particular cost and apply a healthy mark-up. If you look at SaaS, the healthy gross margin for a below $1M ARR product should be above 67%, the median for the market. Once you grow, it should land closer to 79%, with top companies reaching 85% levels. As an example, Slack has an 85.1% gross margin; similarly, Atlassian enjoys an 83.3% margin (data here).

Cost-based pricing is easy-to-use, you always make money with every deal, and we can recommend it to companies that are just starting out. Why? Because when you are starting up, you don't know some things that are necessary to create a more sophisticated pricing equation.

However, such an approach is sensitive to any changes. Let's say you purchase data from a 3rd party vendor. If they increase the chargebacks, it impacts your overall margins. Also, setting it on a cost base makes it stiffer and less flexible for future changes. Considering the SaaS market changes so quickly, you'd be ruining your agility this way.

We recommend this approach to newly-born companies, because if you thoroughly understand your unit economics, customer acquisition costs, payback, data upkeep, AWS server costs, onboarding, and customer support, etc., then you're in good shape to try something more advanced later. But every pricing starts from knowing your cost base.

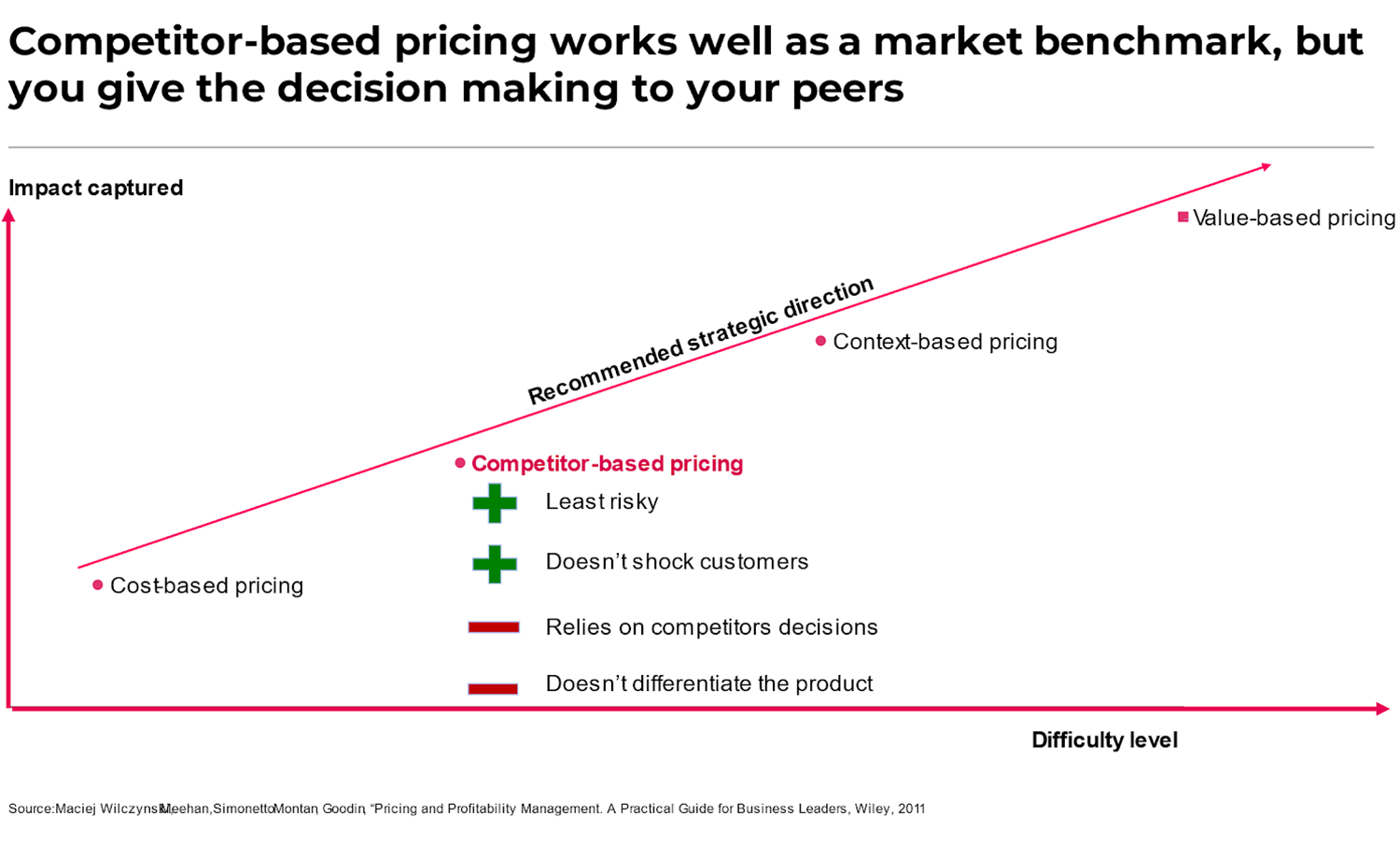

Competitor-based pricing

Let's assume that you have your costs appropriately calculated, which already puts you among only approximately 10% of the SaaS companies worldwide. According to Maciej Wilczyński, CEO of Valueships, a SaaS pricing consultancy:

SaaS products are growing because of a trend, but if they were a traditional business, they would fail. I can't imagine running a production facility without knowing my costs. They don't get their internal costs right, don't capture full value from clients, and pricing is the last thing they think of, and get down to it with trepidation at the end of the product development cycle.

Speaking of value you create within your product. Without detailed customer-centric research and data gathered from the market, it's hard to grasp the value. That's why new companies should try calculating it bottom-up, e.g., the number of hours saved and new deals made. Then you can charge 10-15% of the value created as a rule of thumb.

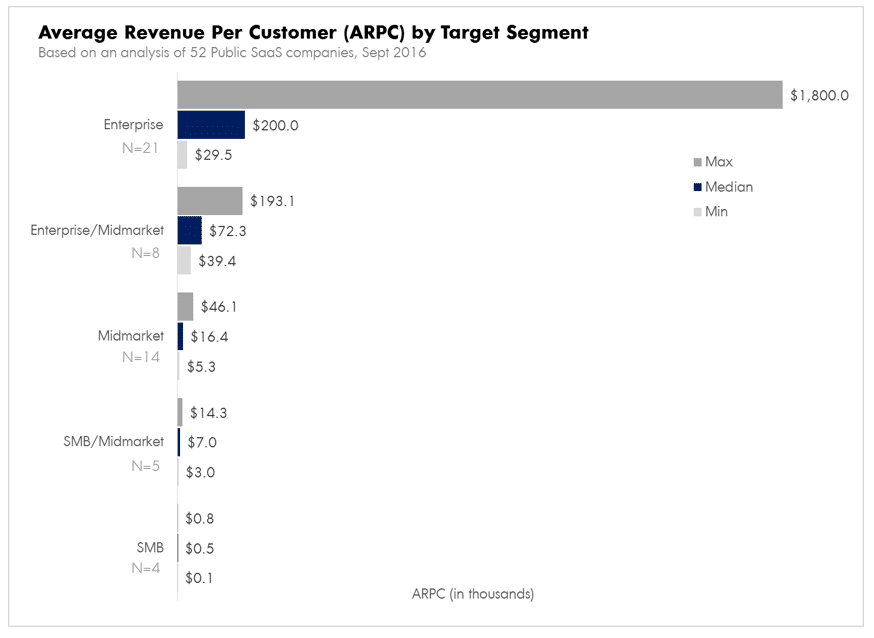

But how to get there? Well, you can carry out competitor-based research, but you need to be careful. Competitor-based pricing is relatively easy, it's less risky as you usually don't over-tweak the prices, and it’s well-received by customers. You can always support your thoughts with the available market benchmarks and land in a pricing corridor that suits your market:

Source: Mastering SaaS Pricing Ebook

It's super easy to fall on false positives, e.g., compare products with different use-cases to one another. For instance, that's the story behind DocuSign, which charges for documents signed, and PandaDoc, which relies more on the templates. In theory, these are the same products, but they target entirely different needs. Another thing is that you probably wouldn't outsource your product development to a competitor, so why do it with your pricing strategy? If you base it 100% on others, then you don't have a pricing strategy - they do and you passively follow. You're better than that.

Context/segment-based pricing

This one is tricky, and if you Google "saas pricing strategies," you probably won't find much if anything about it. Luckily for you, we do know and want to share.

Within this strategy, you try to capture more value from various customer segments. You could call it market segmentation, and that’s precisely what it is. They are all your freelancer/student discounts, lecturers access, NGOs plans, coupons, AppSumos of the world.

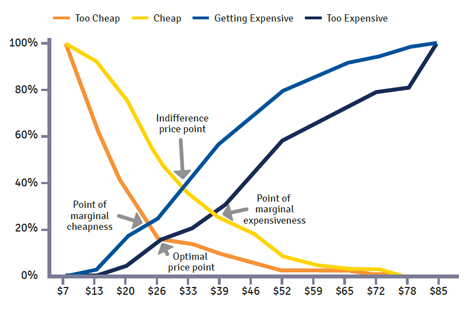

By creating more segments, you can capture more types of customers. Your revenue is effectively a multiple of price and quantity, as you can see on the charts below (which come from here). The more use-cases you serve, the more value you can hold for your own.

This approach works well if you sell your product to the mid-market/enterprise-level and don't disclose your pricing. Not being transparent on the pricing page allows you to try different pricing approaches without laddering your clients. Important notice – by all means, don't A/B test your prices, and try to avoid doing so at all costs as it overcomplicates things, might be illegal, and creates strong pricing friction.

Segment pricing allows you to capture more value for existing segments and gives you excellent control of your pricing process. In other words, it's quoting every customer differently based on the segment situation. However, at the same time, segmenting creates the risk of over tweaking price points, i.e., asking too much because your sales rep thought it would be a good idea.

You need to ensure your pricing setup and pricing execution processes are aligned with each other. We have seen cases where the bid price is 50-70% lower than the realized one. Speaking of that, when creating tailored offers, be very mindful about your sales rep’s commission – how about rewarding them for margins instead of revenues? Yes, unfortunately, you need to know your costs well.

Value-based pricing

The crème de la crème of all SaaS pricing schemes. It's like teenage sex: everyone talks about it, nobody knows how to do it, everyone thinks everyone else is doing it. In fact, according to OpenView research, less than 10% of all companies get it right, and in most cases they're already the big fish on the market.

In its principles, VBP comes back to our first paragraph: knowing how much value your product creates and charging for it. Sounds simple, but it requires three crucial things:

The first is to have a thorough research & analytics process in place. You need to know how to run customer insight surveys and interview rigorously. We talk here about the analysis types you've never heard of: Van Westendorp Price Sensitivity Meter questions, Best-Worst Choice, Conjoint Analyses, etc. It's fine not to know them, but if you want to get your pricing right then it's a must-have:

The second challenge is fully understanding your unit economics (which we've mentioned before) and the value you create with your product. With value-based pricing, what you're charging for is sometimes more important than how much. In this case, getting your value-metric (sometimes known as billing metrics) right is the hardest part. Then you can move to revenue models, packaging, and discounting policies. The final pricing page is usually 3% of the actual work. It's like the front-end and back-end of your product, where the majority of the awesomeness created is hidden.

Last but not least, you need to have someone responsible for pricing. According to Price Intelligently research, companies spend more time choosing the right toilet paper for the office (pre-Covid survey) than they do on pricing decisions. The pricing function falls under many areas: it's partially product, partially finance, partially marketing. That's why, in an ideal world, you should employ a person to be solely responsible for it. We've seen examples where it's connected with the research/analytics department. Having someone do the actual job of monetizing your product, constantly ensuring the offer is right, and regularly increasing prices is critical.

On top of that, you need to increase the fees for existing clients. Trust us; you won't see clients churn if you do it regularly and mindfully. Most companies stay on legacy pricing and grandfather their clients. You constantly develop the product and have certain costs associated with doing so, therefore you should get that money back. It's a business, not a charity organization.

Only if you have these three capabilities can you enable value-based pricing within your organization. There’s a long journey ahead of you, but being in the 90th percentile of the best software-as-a-service companies in the world doesn't come easily.

Good luck!

You may be also interested in:

➤ How to create a project roadmap. A step-by-step guide

➤ 6 common risks in software development projects – and how to avoid them

➤ How to build an MVP. A Guide to Minimum Viable Product

Angry Nerds (Poland)

Angry Nerds (Poland) Angry Nerds (USA)

Angry Nerds (USA) Angry Nerds (Canada)

Angry Nerds (Canada)